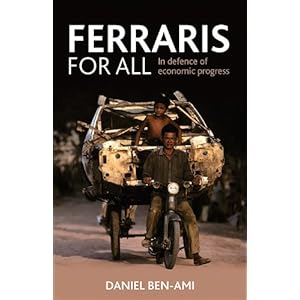

Daniel Ben-Ami is a journalist and author based in London. Visit his website here http://danielbenami.com/ . His new book, medical Ferraris For All: In Defence of Economic Progress, treat is published by Policy Press.

Daniel Ben-Ami is a journalist and author based in London. Visit his website here http://danielbenami.com/ . His new book, medical Ferraris For All: In Defence of Economic Progress, treat is published by Policy Press.

The economic and financial crisis of the past three years has led to widespread criticism of economics from the public and much soul-searching among economists themselves. There is a pervasive sense, even within the profession, that the recent turmoil has found the discipline wanting. Many would accept that a new economics is needed. An approach that is better able to help policy-makers anticipate and tackle economic challenges.

By far the most high profile initiative aimed at tackling the perceived shortcomings of economics was the establishment of the Institute for New Economic Thinking (INET) ( http://ineteconomics.org ) in 2009. The institute, founded with a $50m pledge by George Soros, says it: “believes in empowering the next generation, providing the proper guidance as we challenge outdated approaches with innovative and ethical economic strategy”.

Among the luminaries on INET’s advisory board are several Nobel laureates (George Akerlof, Amartya Sen, Michael Spence and Joseph Stiglitz), two former chief economists at the International Monetary Fund (Simon Johnson and Kenneth Rogoff), high profile economics writers (John Kay of the Financial Times and Anatole Kaletsky of the Times), and many others. Additional notables spoke at its inaugural conference including Dominique Strauss-Kahn (the managing director of the IMF) and Adair Lord Turner (the chairman of Britain’s Financial Services Authority).

But the high-powered character of INET’s leading supporters itself raises an intriguing question. In what sense can the economics they advocate be considered genuinely new? Although some accounts have portrayed INET as a radical organisation, bent on overturning the economic orthodoxy, it is hard to take such claims seriously. Many of INETs supporters apparently consider themselves critics of the mainstream but it is hard to avoid the conclusion that they are themselves pillars of the establishment.

Since there is no official statement of INET’s thinking it is difficult to critically assess its claims to newness. There are certainly significant differences between the leading thinkers who support the organisation. But Kaletsky’s Capitalism 4.0, his recent book suggesting the world is entering a new era of economic pragmatism, is a good starting point. In it he argues that the recent economic and financial crisis has discredited “market fundamentalism” (free market economics) and paved the way for its replacement by a less doctrinaire form of economic thinking.

Kaletsky suggests that the new economics will satisfy three conditions. First, it will accept that a market system is not a static system in equilibrium but one that is constantly evolving. Second, it will have to accept that effective government and dynamic private enterprise are symbiotic. Third, it will need to focus on the inherent unpredictability of human behaviour and economic events.

The striking thing about this list is that it is so mainstream. It would have been accepted as a moderate list well before the crisis of 2008. Even in the economics departments of elite American universities it would have been accepted by many. In the world of practical policy it is totally line with the orthodoxy.

Take Kaletsky’s final points about the unpredictability of human behaviour. Daniel Kahneman and Vernon Smith won the Nobel prize for their work on behavioural finance back in 2002. Admittedly Kahneman is a psychologist but there are many other influential proponents of behavioral economics including Robert Shiller and Richard Thaler (of “Nudge” fame).

The notion of the state and market working together is if anything even more mainstream. Outside of the world of high economic theory it is hard to find many economists advocating a state as limited as that favoured by the likes of Milton Friedman – essentially providing a framework for law and order as well as key public works. For example, despite all the talk of the “Washington Consensus” in the developing world, the World Bank’s annual World Development Report argued explicitly against the idea of a minimal state as far back as 1997.

Economic practice was even more different from that favoured in the textbooks. Even before the crisis struck – in 2006 state spending in Britain was equivalent to about 38% of GDP and in America it was about 35%. – and since then it has risen significantly. America, often viewed as the bastion of market capitalism, the state was responsible for huge public spending programmes, an activist monetary policy and extensive forms of regulation.

It is hard to avoid the conclusion that Kaletsky is over-estimating the difference between economics before 2008 and since. Free market economics, or neo-liberalism as some prefer to call it, had a brief heyday in the late 1970s and early 1980s. But since then economics, certainly in practice, has taken a more pragmatic turn. Even the contemporary discussion of the need for cuts is typically pitched as a regrettable necessity to balance the books rather than as part of an ideological drive to roll back the frontiers of the state.

Of course it is unfair to pick on Kaletsky but it is hard to find radically new ideas from other proponents of the new economics either. For instance, Joseph Stiglitz, not only a Nobel laureate but a former chairman of President Bill Clinton’s Council of Economic Advisers and chief economist of the World Bank, also fails to propose novel ideas. In Aftermath (Allen Lane 2010) he suggests less emphasis on material consumption and more on protecting the natural environment. However, the notion of sustainability, which is essentially what he is advocating, was adopted as United Nations policy in the 1980s.

It is had to resist the conclusion that the advocates of new economics are more interested in rescuing mainstream economics than burying it. No doubt they want changes of presentation and emphasis but the fundamentals of the viewpoint they uphold is essentially unchanged.

None of this is to suggest that all is well with orthodox economics. There is certainly much that needs to be done to strengthen the discipline. But before rushing to declare a new era or to devise a new economics perhaps it is time to rehabilitate what are essentially old ideas. In particular the close link between economic growth and social progress, central to Adam Smith’s political economy in the eighteenth century, would be an excellent place to start.

The following would be the key points on my list:

* Recognising the importance of economic growth. Contemporary economics is incredibly defensive about the potential of rising output to improve human welfare. Any talk of growth is hedged by numerous caveats including the notion of environmental, moral and social limits. Others want to redefine prosperity in non-material terms. Now, at a time when austerity is starting to be imposed, it is more importance than ever to emphasise the importance of growth.

* Transforming the third world rather than sustaining poverty. The aspiration should be to transform poor countries into rich ones rather than simply ameliorate the worst excesses of poverty. Scarcity should be abolished worldwide.

* Promoting innovation. Rediscover the importance of key principles such as taking risks, be prepared to engage in “useless” research such as the Large Hadron Collider, working hard and expecting failures.

* Reducing regulation. This should involve reducing not only the number of rules – “red tape” – but what could also be called “green tape”: regulations that embody the notion of limits. These should include the precautionary principle and sustainability; both of which embody a cautious and narrow approach to economic progress.

* Ending the obsession with bankers. The moralistic obsession with “greedy bankers” is a distraction from the vital task of rebuilding a healthy economy.

* Remembering that the economy should not simply be viewed from the perspective of the consumer. Humans are not just consumers of goods and services but producers who can find solutions to the problems they face. The power of human ingenuity to overcome economic challenges should not be underrated.

Once some of the old insights of economics are rediscovered we will be in a better position to tackle the genuinely new.

Ferraris For All: In Defence of Economic Progress ,

is published by Policy Press.

[…] have written a critique of the new economics – or more accurately “new” economics – for the Economic Policy Centre in London. It […]

Great points.

I think it’s also worth adding the call for economics to clarify the unconditional benefits of productivity improvements, both extensive and intensive; as well as teaching students of the economy to appreciate the unique historical benefits of rising labour productivity.

Secondly, I think economic analysis would be greatly improved by demanding more and better data collection and empirical research is resored to its proper place ahead of the scientistic pretensions of econometrics. More emphasis on a basic understanding of reliable data and the methodology of statistics provides a far more robust approach to economic analysis.

I certainly agree about the role – even though Daniel Ben-Ami needs a philosopical & ideological reality check. It is understandable for ordinary people like me that he has a motive in his mind. That is why he needs to think carefully before something happens in practice.

He also forgets the M word – it stands for the manufacturing sector – and we ordinary people have to understand the actual merits of a broad industrial sector, especially the energy, transportation, business processing, research, development & deployment and, of course, manufacturing. That is why actual productivity benefits are accrued from improvements in these sectors, and it will remain viable now and always.

As for regulatory policies, how can possibly go wrong with those real abuses that must be targeted before it is too late, while at the same time, the stupidity of overregulation of society in various nations is, in effect, a price to pay for trying to deal with imaginary problems? Discuss it well and get the right choice in targeting only real abuses in financial, industrial, and other sectors – ordinary people are demanding more regulation that is really effective against the constant threat of such abuses! No one will refuse to accept what is very important in ensuring social & economic stability, environmental conservation and protection, public governance & safety, energy, communications and transportation improvements, and a lot more. I believe it is a rather different task to be reckonned with.

I like to note that promoting innovation is a surefire way to, well, promote innovation! Let’s not overexagerrate on this, OK? Please understand the true merits of “promoting innovation” because some are good, some are not good – thus, it is part of risk-taking, engaging-in-“useless”-research, working-hard and making-mistakes sort of schemes – yet the best ones can also be included in the discussion. Remeber: Discuss, discuss, discuss about innovation promotion policies – do not forget it!

“Bashing the bankers”?! Do not forget to discuss carefully and take action on the situation, because “banker bashing” is a really mad, bad, and dangerous idea which may result in legal, political, social and other costs of not helping the bankers and other people in the financial sector to ensure their responsibility and integrity in maintaining steady growth.

Please be aware that the transformation of third-world countries into rich ones can be a priority, so why some poor countries need to focus so much on ways to ameliorate, rather than reduce, the incidence of tropical diseases, illiteracy, malnutrition, environmental problems, economic & social underdevelopment, corruption, terrorism, crime, etc., while others are trying to reduce but, still, never happens? There are nations that are doing the right thing by turning third-world countries themselves into rich ones. Can anyone please describe the nations which are different to those of the United States, Canada, European countries and Japan? And, oh, can someone please discuss it carefully about how to lessen the worst excesses of poverty, as well as how to reduce illiteracy, how to confront the incidence of corruption, crime and terrorism, how to implement and use the vital tools of environmental conservation & protection, social & economic development, energy, communications and transportation improvements, how to implement and enforce effective public governance & safety, and how to recognize – and appreciate – economic growth on a per GDP per capita income basis and improving the living standards among the people in third-world nations? Need to know more? Give me a reply, and thank you.

And finally, please discuss very carefully about what is the genuine recognition of economic growth and the role of humans as both consumers of goods & services and as producers who can find solutions (not just simple solutions but also complex ones) to the problems they face. The power of human ingenuity to overcome economic and social challenges must be appreciated. Without it, we will never be able to prevent those real problems from happening. The time has come for us ordinary people to recognize and appreciate the true meanings of economic growth and the role of humans as both consumers and producers whether in the mainstream society, the corporate sector, the goverment sector, science & technology, the industrial sector, the services sector, or any other in both the developed and developing countries. Ridding the world of scarcity must also be a priority on a per GDP per capita income basis – but do not let anyone exploit this for ideological gains, thank you very much.

The rediscovery of the genuinely old insights of economics will enable us to understand the theory and practice of, well, economics – and we will surely be in a better position to tackle the really new challenges.

Be warned, though: excessive politicking can be a roadblock towards a better life. It is because of both philosopical and ideological motives which are ulterior and, thus, undermining the real purpose of economic growth and human ingenuity.

So, do not hold our breath until debate and cooperation are permitted to take action on the true philosopical & ideological motives behind the so-called “growth skepticism”. The difficulties may vary, and the challenges are enormous, but the spirit of both balanced discussion and cooperation are a neccessity. Do not forget what we must confront with, understand? Time to get going! Thanks.

It is true that a lot of “new economics” is old hat, or sophistry to obfuscate the collapse of cherished paradigms and reputations. But the falsification of much of the nonsense that has been taught within mainstream economics for the past century is an important opportunity to reverse out of a number of intellectual culs-de-sac and start afresh – rehabilitating some ideas that had been discarded by the economics establishment (the guardians of the mainstream), as well as integrating important new insights. We shouldn’t let the defensive efforts of discredited economists and schools deter us from seizing the opportunity to make economics once again a valid and valuable field of study.

Roger Koppl of Fairleigh Dickinson University has been doing some interesting work (with his associates) on the trends of “new economics” (http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1580145). He uses the acronym BRACE to refer to the mainstream attempts to develop a “new economics” based on the old, but incorporating Bubbles, Radical uncertainty, Animal spirits, Complexity dynamics, and Extra-market Control, much as Mr Ben-Ami describes. He also presents a critique of these attempts, and (in his “Big Players” book – http://www.amazon.co.uk/Big-Players-Economic-Theory-Expectations/dp/0333678265/ – and elsewhere) the bones of a more credible alternative.

It should be emphasised that it is unfair to tar some INET contributors, like Simon Johnson, with the Kaletsky brush. Johnson’s reputation is deservedly enhanced by recent history. His arguments fit well with Koppl’s. So (to some extent, e.g. reflexivity) do Soros’s own thoughts on economics, which were so harshly lampooned by sections of the economics establishment (before they wanted his money). It is understandable, perhaps even admirable, that INET has chosen initially to cast its net so widely that it has room for Kaletsky and Skidelsky as well as Johnson. But let’s hope they throw back the intellectual tiddlers as the debate develops. At least the mesh is not so fine that it landed a Krugman.

To reduce developing world poverty it is necessary to promote civic education to reduce what in the developed world would be recognised as corruption. This needs to be done in th developing world rather than by providing indigenous elites with a free western education to broaden appreciation of how political and economic systems interact in the developing world. It is, however, arguable in the case of Africa political elits may increasingly look to the Chies political model as economic ties with the West decline, replaced by economic dependency on China buying raw materials for manufacturing.

As we have seen in eastern Europe, by changing what is possible in politics and economics wealth will create itself spontaneously.

More wealth spread more widely across the citizens of developing economies can only be good for the planet as a whole, in turn generating wealth in the developed world as today’s receivers of charity donations become tomorrow’s consumers.