Ok – so much for France’s leaders instructing the ratings agencies to downgrade Britain. I don’t think for a moment that things are that great here but those agencies will have noticed that the UK’s position is better than France for some of the following rather important reasons;

i) Longer average maturities of British government bonds (gilts, we should say) – 13-14 years versus 7-10 years for France. This means that the French government has to raise more capital over a shorter period of time to pay its bills.

ii) Less foreign ownership of those government bonds – the BoE owns a lot – purchased from financial institutions – due to quantitative easing and will not dump them anytime soon, making yields shoot up

iii) Much, much less exposure of UK banks to Southern European sovereign debt – particularly Greece

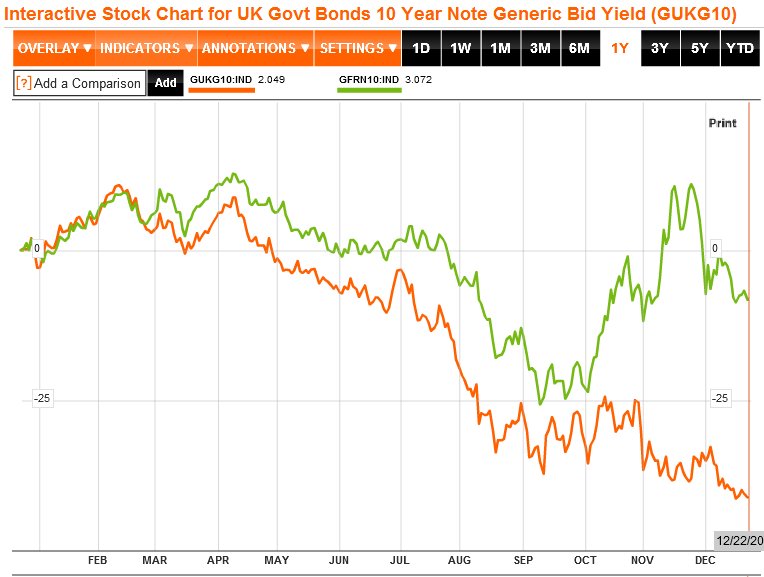

For these reasons and some others, the UK government currently (as at 22/12/2011) pays just over 1 % less for 10 year debt – 2.049% versus 3.072% – as per the chart from Bloomberg below.

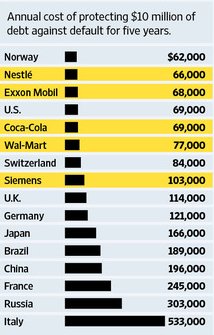

That’s bad enough. But yesterday I caught sight of a fascinating article in the WSJ, Super-Safe Assets Run Short Around Globe. As this table from the article shows, safety conscious investors appear to be putting a much higher premium on the cost of insuring French debt against default – more than two and a half times – than the UK’s over 5 years. In fact, the UK is even ahead of Germany.

CDS spreads are not a perfect guide to the future of course. And I’m not sure about Switzerland being behind the USA. Still, they do give us a rather more complete picture that includes investor sentiment – and right now, that is looking far from reassuring.